4 Bedrooms, 2 Baths, 2 car garage, 2083 Sq.Ft Built in 2006.

3 Bedrooms, 2.5 Baths, 3 car garage, 2993 Sq.Ft Built in 2006.

The National Association of Realtors recently released a study titled 'Social Benefits of Homeownership and Stable Housing.’ The study confirmed a long-standing belief of most Americans:

“Owning a home embodies the promise of individual autonomy and is the aspiration of most American households. Homeownership allows households to accumulate wealth and social status, and is the basis for a number of positive social, economic, family and civic outcomes.”

Today, we want to cover the section of the report that quoted several studies concentrating on the impact homeownership has on educational achievement. Here are some of the major findings on this issue revealed in the report:

People often talk about the financial benefits of homeownership. As we can see, there are also social benefits of owning your own home.

This is truly the most important question to answer. Forget the finances for a minute. Why did you even begin to consider purchasing a home? For most, the reason has nothing to do with money.

For example, a survey by Braun showed that over 75% of parents say “their child’s education is an important part of the search for a new home.”

This survey supports a study by the Joint Center for Housing Studies at Harvard University which revealed that the top four reasons Americans buy a home have nothing to do with money. They are:

What does owning a home mean to you? What non-financial benefits will you and your family gain from owning a home? The answer to that question should be the biggest reason you decide to purchase or not.

According to the latest Existing Home Sales Report from the National Association of Realtors (NAR), the median price of homes sold in December (the latest data available) was $232,200, up 4.0% from last year. This increase also marks the 58th consecutive month with year-over-year gains.

If we look at the numbers year over year, CoreLogic forecasted a rise by 4.7% from December 2016 to December 2017. On a home that costs $250,000 today, that same home will cost you an additional $11,750 if you wait until next year.

Simply put, with prices increasing each month, it might cost you more if you wait until next year to buy. Your down payment will also need to be higher in order to account for the higher price of the home you wish to buy.

A buyer must be concerned about more than just prices. The ‘long-term cost’ of a home can be dramatically impacted by even a small increase in mortgage rates.

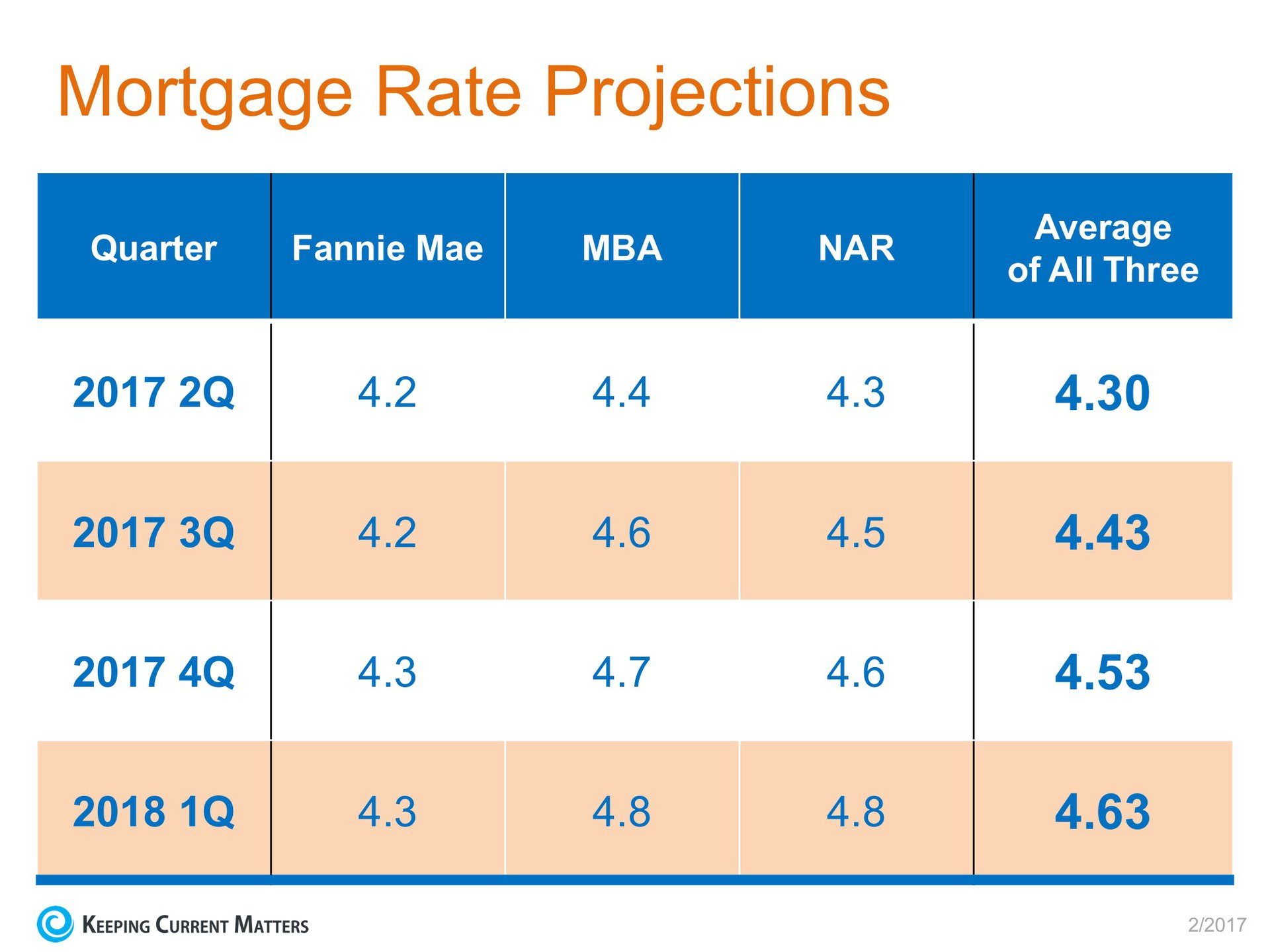

The Mortgage Bankers Association (MBA), the National Association of Realtors, and Fannie Mae have all projected that mortgage interest rates will increase over the next twelve months, as you can see in the chart below:

Only you and your family will know for certain if now is the right time to purchase a home. Answering these questions will help you make that decision.

In this day and age of being able to shop for anything anywhere, it is really important to know what you’re looking for when you start your home search.

If you’ve been thinking about buying a home of your own for some time now, you’ve probably come up with a list of things that you’d LOVE to have in your new home. Many new homebuyers fantasize about the amenities that they see on television or Pinterest, and start looking at the countless homes listed for sale through rose-colored glasses.

Do you really need that farmhouse sink in the kitchen in order to be happy with your home choice? Would a two-car garage be a convenience or a necessity? Could the ‘man cave’ of your dreams be a future renovation project instead of a make-or-break right now?

The first step in your home buying process should be to get pre-approved for your mortgage. This allows you to know your budget before you fall in love with a home that is way outside of it.

The next step is to list all the features of a home that you would like, and to qualify them as follows:

Having this list fleshed out before starting your search will save you time and frustration, while also letting your agent know what features are most important to you before starting to show you houses in your desired area.

The housing crisis is finally in the rear-view mirror as the real estate market moves down the road to a complete recovery. Home values are up. Home sales are up. Distressed sales (foreclosures and short sales) have fallen dramatically. It seems that 2017 will be the year that the housing market races forward again.

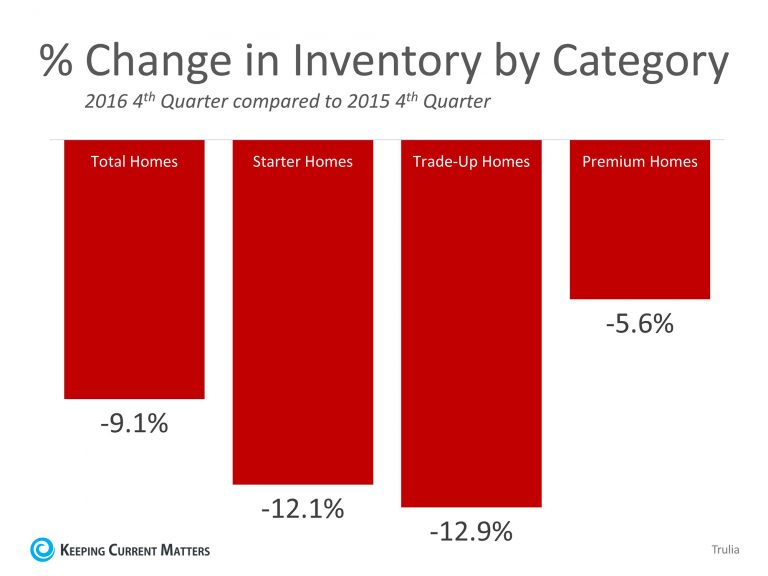

However, there is one thing that may cause the industry to tap the brakes: a lack of housing inventory. While buyer demand looks like it will remain strong throughout the winter, supply is not keeping up.

“Total housing inventory at the end of December dropped 10.8%...which is the lowest level since NAR began tracking the supply of all housing types in 1999. Inventory has fallen year-over-year for 19 straight months and is at a 3.6-month supply at the current sales pace.”

“More than two-thirds of the markets are seeing less inventory now compared to a year ago.”

“The dismal number of listings in the affordable price range is squeezing prospective first-time buyers the most. As a result, young households are missing out on the wealth gains most homeowners have accrued from the 41% cumulative rise in existing home prices since 2011.”

“The lack of affordable supply is really driving up home prices.”

“Tight housing inventory remains a constraining factor limiting stronger sales growth…

We expect further price growth to entice more homeowners to list their homes, particularly as existing homeowners have greater equity.”

If you are thinking of selling, now may be the time. Demand for your house will be strong at a time when there is very little competition. That could lead to a quick sale for a really good price.

The most recent Housing Pulse Survey released by the National Association of Realtorsrevealed that the two major reasons Americans prefer owning their own home instead of renting are:

In a recent article by The Mortgage Reports, they report that “buying and owning a home is the essence of ‘The American Dream.’ Each month, your housing payments go toward owning your home instead of renting it; building your personal wealth and assets instead of someone else’s.

History has shown that homeownership is a clear path to wealth-building, with homeowners boasting a net worth [that is] multiples higher than the net worth of renters.”

Does owning your home really create a more stable environment for your family?

A survey of property managers conducted by rent.com disclosed two reasons tenants should feel less stable with their housing situation:

We can see from these survey results that renting will provide anything but a stable environment in the near future.

Homeowners enjoy a more stable environment, and at the same time are given the opportunity to build their family’s net worth.

If you have saved up your down payment and are ready to start your home search, one other piece of the puzzle is to make sure that you have saved enough for your closing costs.

Freddie Mac defines closing costs as:

“Closing costs, also called settlement fees, will need to be paid when you obtain a mortgage. These are fees charged by people representing your purchase, including your lender, real estate agent, and other third parties involved in the transaction. Closing costs are typically between 2 and 5% of your purchase price.”

We’ve recently heard from many first-time homebuyers that they wished that someone had let them know that closing costs could be so high. If you think about it, with a low down payment program, your closing costs could equal the amount that you saved for your down payment.

Here is a list of just some of the fees/costs that may be included in your closing costs, depending on where the home you wish to purchase is located:

Work with your lender and real estate agent to see if there are any ways to decrease or defer your closing costs. There are no-closing mortgages available, but they end up costing you more in the end with a higher interest rate, or by wrapping the closing costs into the total cost of the mortgage (meaning you’ll end up paying interest on your closing costs).

Home buyers can also negotiate with the seller over who pays these fees. Sometimes the seller will agree to assume the buyer’s closing fees to get the deal finalized, which is known in the industry as ‘seller’s concession.’

Speak with your lender and agent early and often to determine how much you’ll be responsible for at closing. Finding out you’ll need to come up with thousands of dollars right before closing is not a surprise anyone is ever looking forward to.

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 4.09%, which is still very low in comparison to recent history!

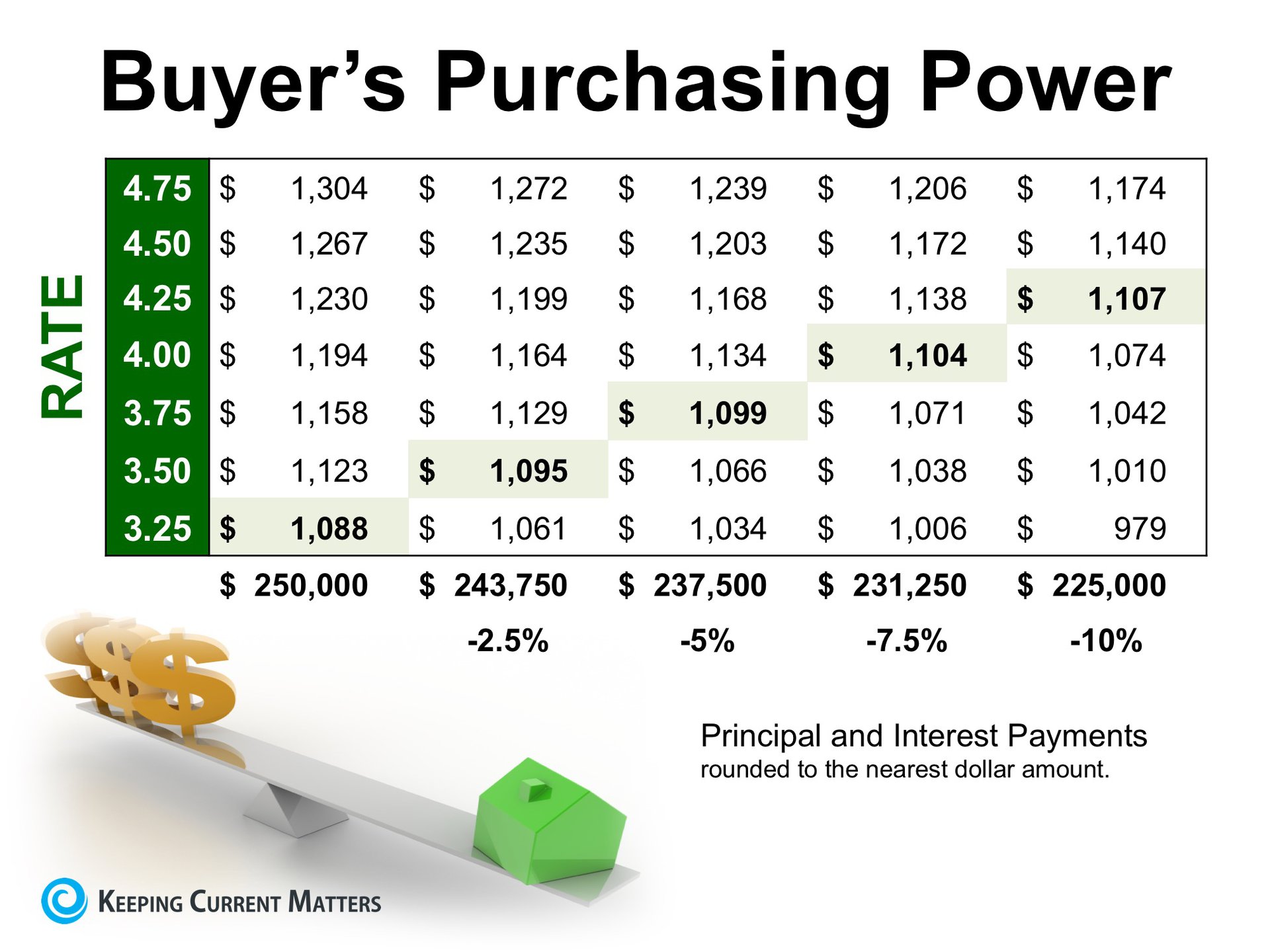

The interest rate you secure when buying a home not only greatly impacts your monthly housing costs, but also impacts your purchasing power.

Purchasing power, simply put, is the amount of home you can afford to buy for the budget you have available to spend. As rates increase, the price of the house you can afford will decrease if you plan to stay within a certain monthly housing budget.

The chart below shows what impact rising interest rates would have if you planned to purchase a home within the national median price range, and planned to keep your principal and interest payments at or about $1,100 a month.

With each quarter of a percent increase in interest rate, the value of the home you can afford decreases by 2.5%, (in this example, $6,250). Experts predict that mortgage rates will be closer to 5% by this time next year.

According to ATTOM Data Solutions’ 2017 Rental Affordability Report, buying a home is more affordable than renting in 354 of the 540 U.S. counties they analyzed.

The report found that “making monthly house payments on a median-priced home — including mortgage, property taxes and insurance — is more affordable than the fair market rent on a three-bedroom property in 354 of the 540 counties analyzed in the report (66 percent).”

For the report, ATTOM Data Solutions compared recently released fair market rent data from the Department of Housing and Urban Development with reported income amounts from the Department of Labor and Statistics to determine the percentage of income that a family would have to spend on their monthly housing cost (rent or mortgage payments).

Rents have been surging faster than home prices in about 37% of the markets measured. Daren Blomquist, Senior Vice President of ATTOM Data Solutions warns that rising interest rates could be the tipping point of affordability:

“While buying continues to be more affordable than renting in the majority of U.S. markets, that equation could change quickly if mortgage rates keep rising in 2017. In that scenario, renters who have not yet made the leap to homeownership will find it even more difficult to make that leap this year.”

Rents will continue to rise and mortgage interest rates are still at historic lows. Before you sign or renew your next lease, meet with a local professional who can help you determine if you are able to buy a home of your own and lock in your monthly housing expense.

So you made an offer, it was accepted, and now your next task is to have the home inspected prior to closing. More often than not, your agent may have made your offer contingent on a clean home inspection.

This contingency allows you to renegotiate the price paid for the home, ask the sellers to cover repairs, or even, in some cases, walk away. Your agent can advise you on the best course of action once the report is filed.

Your agent will most likely have a short list of inspectors that they have worked with in the past that they can recommend to you. Realtor.com suggests that you consider the following 5 areas when choosing the right home inspector for you:

Ask your inspector if it’s ok for you to tag along during the inspection, that way they can point out anything that should be addressed or fixed.

Don’t be surprised to see your inspector climbing on the roof, crawling around in the attic, and on the floors. The job of the inspector is to protect your investment and find any issues with the home, including but not limited to: the roof, plumbing, electrical components, appliances, heating & air conditioning systems, ventilation, windows, the fireplace & chimney, the foundation and so much more!

They say ‘ignorance is bliss,’ but not when investing your hard-earned money in a home of your own. Work with a professional you can trust to give you the most information possible about your new home so that you can make the most educated decision about your purchase.

Fannie Mae’s article, “What Consumers (Don’t) Know About Mortgage Qualification Criteria,” revealed that “only 5 to 16 percent of respondents know the correct ranges for key mortgage qualification criteria.”

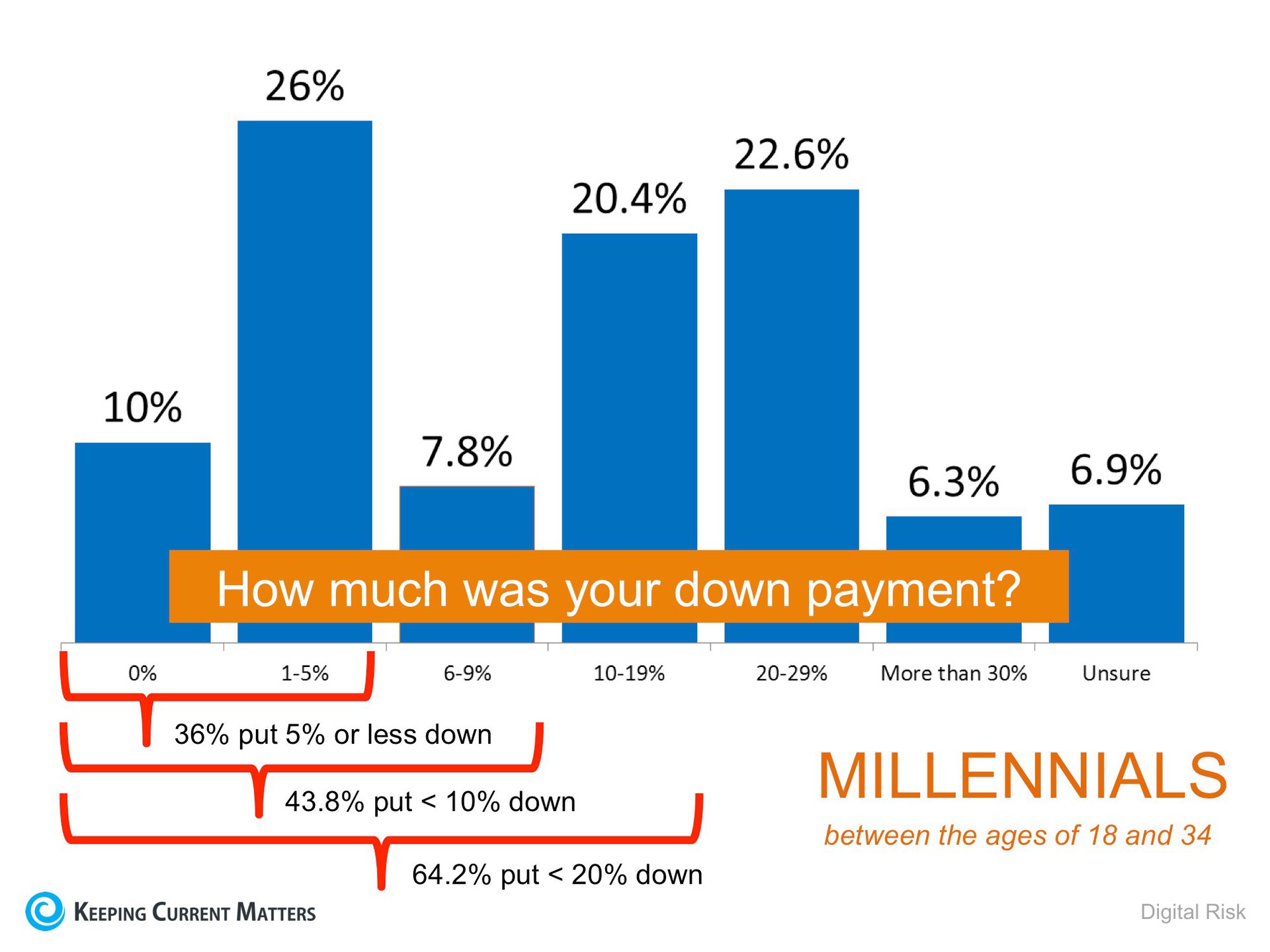

Fannie Mae’s survey revealed that consumers overestimate the down payment funds needed to qualify for a home loan. According to the report, 76% of Americans either don’t know (40%) or are misinformed (36%) about the minimum down payment required.

Many believe that they need at least 20% down to buy their dream home, but many programs actually let buyers put down as little as 3%.

Below are the results of a Digital Risk survey of Millennials who recently purchased a home.

As you can see, 64.2% were able to purchase their home by putting down less than 20%, with 43.8% putting down less than 10%!

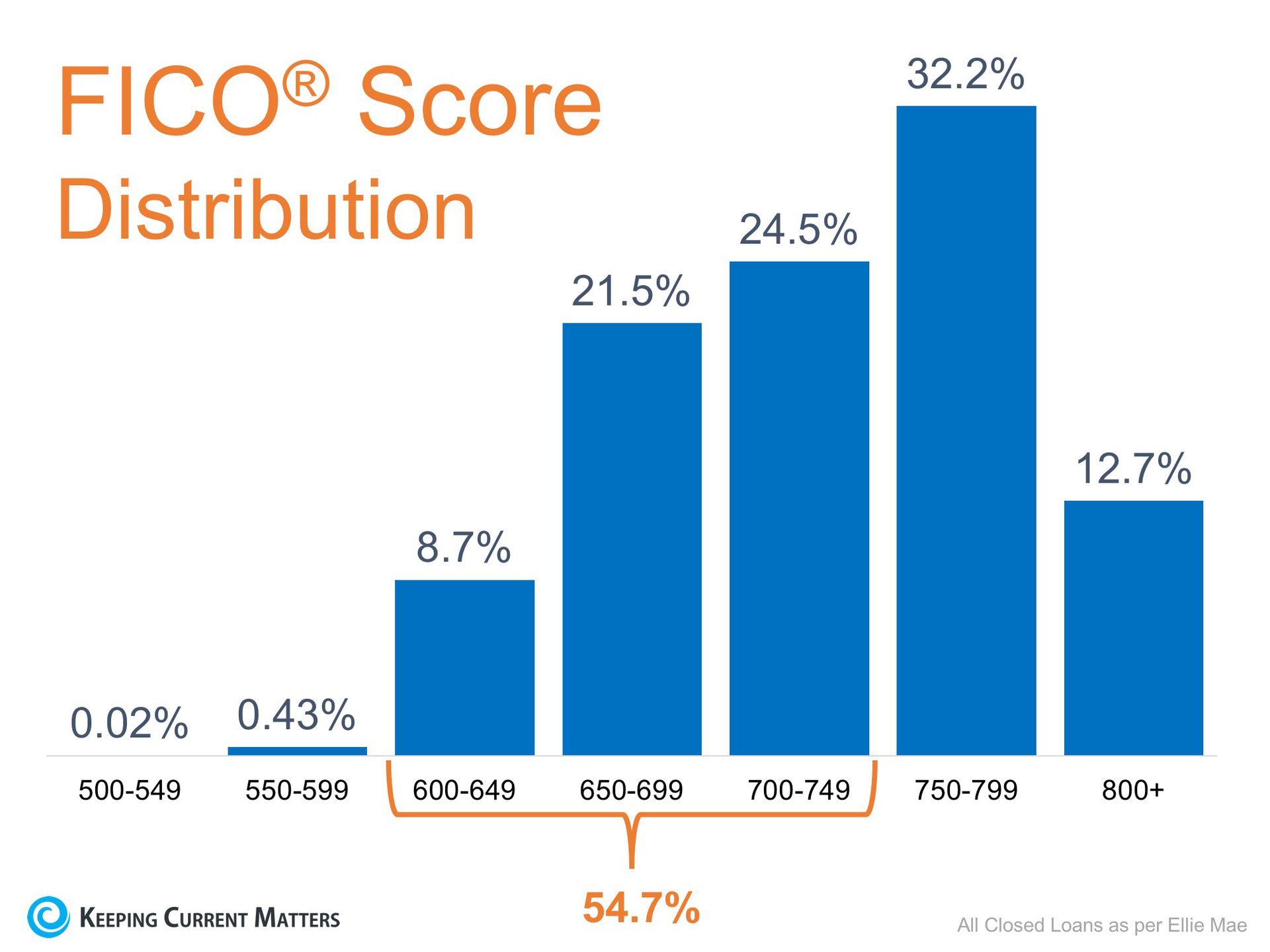

The survey revealed that 59% of Americans either don’t know (54%) or are misinformed (5%) about what FICO score is necessary to qualify.

Many Americans believe a ‘good’ credit score is 780 or higher.

To help debunk this myth, let’s take a look at Ellie Mae’s latest Origination Insight Report, which focuses on recently closed (approved) loans. As you can see below, 54.7% of approved mortgages had a credit score of 600-749.

Whether buying your first home or moving up to your dream home, knowing your options will make the mortgage process easier. Your dream home may already be within your reach.

So you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market that you want to make sure you make a good offer so that you can guarantee your dream of making this house yours comes true!

Freddie Mac covered “4 Tips for Making an Offer” in their latest Executive Perspective. Here are the 4 Tips they covered along with some additional information for your consideration:

“While it's not nearly as fun as house hunting, fully understanding your finances is critical in making an offer.”

This ‘tip’ or ‘step’ really should take place before you start your home search process.

As we’ve mentioned before, getting pre-approved is one of many steps that will show home sellers that you are serious about buying, and will allow you to make your offer with the confidence of knowing that you have already been approved for a mortgage for that amount. You will also need to know if you are prepared to make any repairs that may need to be made to the house (ex: new roof, new furnace).

“Even though there are fewer investors, the inventory of homes for sale is also low and competition for housing continues to heat up in many parts of the country.”

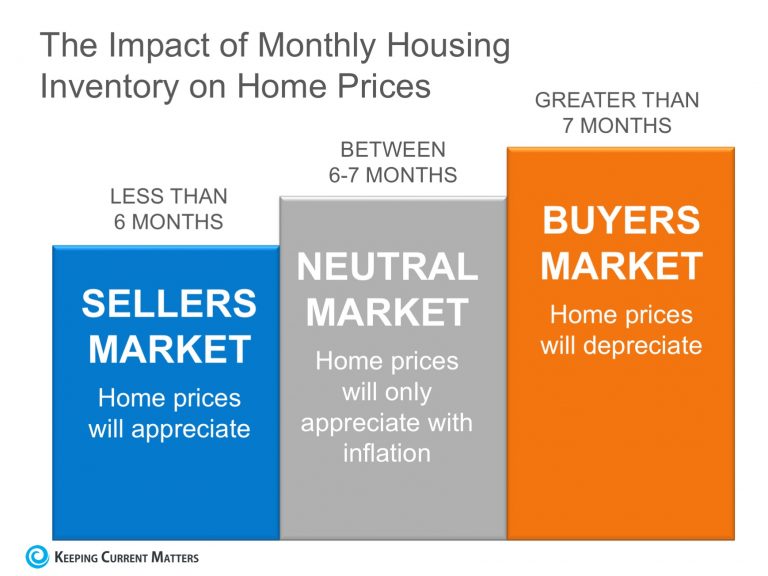

According to the latest Existing Home Sales Report, the inventory of homes for sale is currently at a 3.6-month supply; This is well below the 6-month supply that is needed for a ‘normal’ market. Buyer demand has continued to outpace the supply of homes for sale, causing buyers to compete with each other for their dream homes.

Make sure that as soon as you decide that you want to make an offer, you work with your agent to present it as soon as possible.

Freddie Mac offers this advice to help make your offer the strongest it can be:

“Your strongest offer will be comparable with other sales and listings in the neighborhood. A licensed real estate agent active in the neighborhoods you are considering will be instrumental in helping you put in a solid offer based on their experience and other key considerations such as recent sales of similar homes, the condition of the house and what you can afford.”

Consider ways of making your offer stand out! Many buyers write a personal letter to the seller letting them know how much they would love to be the new homeowners. Your agent will be able to help you figure out if there are any other ways your offer could stand out above the rest.

“It's likely that you'll get at least one counteroffer from the sellers so be prepared. The two things most likely to be negotiated are the selling price and closing date. Given that, you'll be glad you did your homework first to understand how much you can afford.

Your agent will also be key in the negotiation process, giving you guidance on the counteroffer and making sure that the agreed-to contract terms are met.”

If your offer is approved, Freddie Mac urges you to “always get an independent home inspection, so you know the true condition of the home." If the inspection uncovers undisclosed problems or issues, you can discuss any repairs that may need to be made, with the seller, or cancel the contract.

Whether you are buying or selling a home, it can be quite an adventurous journey; you need an experienced Real Estate Professional to lead you to your ultimate goal. In this world of instant gratification and internet searches, many sellers think that they can For Sale by Owner or FSBO.The 5 Reasons You NEED a Real Estate Professional in your corner haven’t changed, but rather have been strengthened, due to the projections of higher mortgage interest rates & home prices as the market continues to pick up steam.

Each state has different regulations regarding the contracts required for a successful sale, and these regulations are constantly changing. A true Real Estate Professional is an expert in their market and can guide you through the stacks of paperwork necessary to make your dream a reality.

According to the Orlando Regional REALTOR Association, there are over 230 possible actions that need to take place during every successful real estate transaction. Don’t you want someone who has been there before, someone who knows what these actions are, to make sure that you acquire your dream?

So maybe you’re not convinced that you need an agent to sell your home. However, after looking at the list of parties that you need to be prepared to negotiate with, you’ll realize the value in selecting a Real Estate Professional. From the buyer (who wants the best deal possible), to the home inspection companies, to the appraiser, there are at least 11 different people that you will have to be knowledgeable with and answer to, during the process.

4. What is the home you’re buying/selling really worth?

It is important for your home to be priced correctly from the start to attract the right buyers and shorten the time that it’s on the market. You need someone who is not emotionally connected to your home to give you the truth as to your home’s value. According to the National Association of REALTORS, “the typical FSBO home sold for $185,000 compared to $245,000 among agent-assisted home sales.”

Get the most out of your transaction by hiring a professional.

There is so much information out there on the news and the internet about home sales, prices, and mortgage rates; how do you know what’s going on specifically in your area? Who do you turn to in order to competitively price your home correctly at the beginning of the selling process? How do you know what to offer on your dream home without paying too much, or offending the seller with a lowball offer?

Dave Ramsey, the financial guru, advises:

“When getting help with money, whether it’s insurance, real estate or investments, you should always look for someone with the heart of a teacher, not the heart of a salesman.”

Hiring an agent who has their finger on the pulse of the market will make your buying or selling experience an educated one. You need someone who is going to tell you the truth, not just what they think you want to hear.

According to a recent analysis by CoreLogic, Millennial renters (aged 20-34) who have student loan debt also have higher credit scores than those who do not have student loans.

This may come as a surprise, as there is so much talk about student loans burdening Millennials and holding them back from many milestones that previous generations have been able to achieve (i.e. homeownership, investing for retirement).

CoreLogic used the information provided on rental applications and the applicants’ credit history from credit bureaus to determine if there was a correlation between student loan debt and credit scores.

The analysis concluded that:

“Student loan debt did not prevent millennials from access to credit even though it may delay their homebuying decisions.”

In fact, those with a higher amount of debt actually had higher credit scores.

“Renters with student loan debt have higher average credit scores than those without; and those with higher debt amounts have higher average credit scores than those with lower student loan debt amounts.”

“Despite the fact that student loan debt has grown into the nation’s second largest consumer debt, following mortgage, and has created a significant financial burden for millennials, it does not appear to prevent millennials from accessing credit.”

You may have heard that the Federal Reserve raised rates last week… But what does that mean if you are looking to buy a home in the near future?

Many in the housing industry have predicted that the Federal Open Market Committee (FOMC), the policy-making arm of the Federal Reserve, would vote to raise the federal fund's target rate at their December meeting. For only the second time in a decade, this is exactly what happened.

There were many factors that contributed to the 0.25 point increase (from 0.50 to 0.75), but many are pointing to the latest jobs report and low unemployment rate (4.6%) as the main reason.

Tim Manni, Mortgage Expert at Nerd Wallet, had this to say,

“Homebuyers shouldn’t be particularly concerned with [last week’s] Fed move. Even with rates hovering over 4 percent, they’re still historically low. Most market observers are expecting a gradual rise in home loan rates in the near term, anticipating mortgage rates to stay under 5 percent through 2017.”

It appears that Americans are regaining faith in the U.S. economy. The following indexes have each shown a dramatic jump in consumer confidence in their latest surveys:

It usually means good news for the housing market when the country sees an optimistic future. People begin to dream again about the home their family has always wanted, and some make plans to finally make that dream come true.

If you are considering moving up to your dream home, it may be better to do it earlier in the year than later. The two components of your monthly mortgage payment (home prices and interest rates) are both projected to increase as the year moves forward, and interest rates may increase rather dramatically. Here are some predictions on where rates will be by the end of the year:

We think that conforming 30-year fixed rates probably make it into the4.625 percent to 4.75 percent range at some point during 2017 as a peak.”

“I wouldn’t be surprised if the 30-year fixed mortgage rate hits 4.75 percent.”

“[I see] mortgage rates getting much closer to 5 percent at the end of next year.”

“By this time next year, expect the 30-year fixed rate to likely be in the 4.5 percent to 5 percent range.”

In many markets across the country, the number of buyers searching for their dream homes greatly outnumbers the amount of homes for sale. This has led to a competitive marketplace where buyers often need to stand out. One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

Even if you are in a market that is not as competitive, knowing your budget will give you the confidence of knowing if your dream home is within your reach.

Freddie Mac lays out the advantages of pre-approval in the My Home section of their website:

“It’s highly recommended that you work with your lender to get pre-approved before you begin house hunting. Pre-approval will tell you how much home you can afford and can help you move faster, and with greater confidence, in competitive markets.”

One of the many advantages of working with a local real estate professional is that many have relationships with lenders who will be able to help you with this process. Once you have selected a lender, you will need to fill out their loan application and provide them with important information regarding “your credit, debt, work history, down payment and residential history.”

Freddie Mac describes the 4 Cs that help determine the amount you will be qualified to borrow:

Have you ever been flipping through the channels, only to find yourself glued to the couch in an HGTV binge session? We’ve all been there… watching entire seasons of “Love it or List it,” “Fixer Upper,” “House Hunters,” “Property Brothers,” and so many more, just in one sitting.

When you’re in the middle of your real estate themed show marathon, you might start to think that everything you see on TV must be how it works in real life, but you may need a reality check.

Truth: There may be buyers who fall in love and buy the first home they see, but according to the National Association of Realtors the average homebuyer tours 10 homesas a part of their search.

Truth: The reality is being staged for TV. Many of the homes being shown are already sold and are off the market.

Truth: Since there is no way to show the entire buying process in a 30-minute show, TV producers often choose buyers who are further along in the process and have already chosen a home to buy.

Recently released data from the National Center for Health Statistics revealed that 1.3 million Millennial women gave birth for the first time in 2015. There are now over 16 million women in this generation who have become mothers.

“All told, Millennial women (those born between 1981 to 1997) accounted for about eight in ten (82%) of U.S. births in 2015.”

The data also shows that this generation has waited until later in life to become parents as only 42% of Millennial women were moms in 2014, compared to 49% of Generation X at the same age. A Pew Research Center article discussing the data, points to social influences that may have contributed to the delay:

“The rising age at first birth is hardly limited to the Millennial generation. It has been a trend since at least 1970. Many factors may contribute, including a shift away from marriage, increasing educational attainment and the movement of women into the labor force.”

“While Millennials may be delaying parenthood, it’s not for a lack of interest in eventually becoming moms and dads. Members of this generation rated being a good parent as a top priority in a 2010 Pew Research Center survey.

Some 52% said it was one of the most important goals in their lives, well ahead of having a successful marriage, which 30% said was one of their most important lifetime goals.”

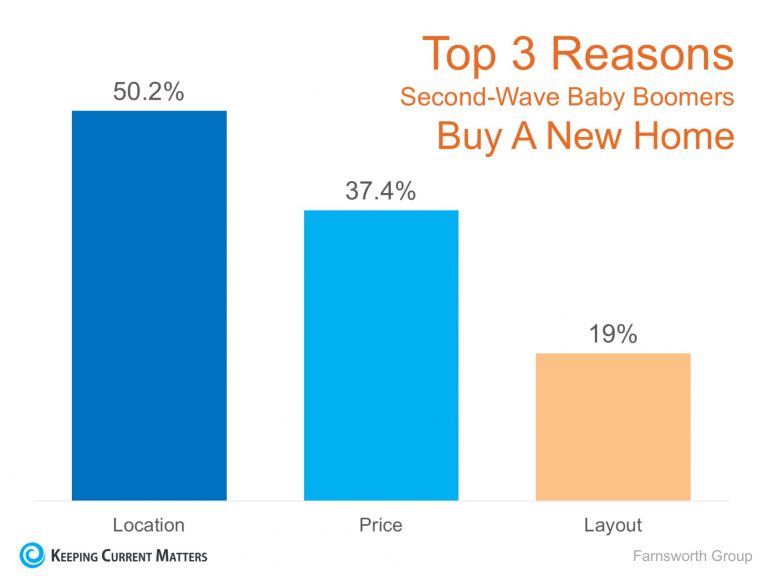

According to data from the U.S Census bureau, there are approximately 76.4 million baby boomers living in the United States today. Contrary to what many think, there are very different segments within this generation, and one piece that sets them apart are their housing needs.

John McManus, editorial director of Hanley Wood’s Residential Group says his company“is focusing on the preferences of the younger half, or second-wave baby boomers, as they exhibit different needs than the older boomers.”

McManus says, “They are seeking a fun, dynamic lifestyle with a home that can also adjust to their changing needs in the future. Living space should either include accessibility features, such as doorway space, lower shelves, and nonslip surfaces, or be easily adjustable when the time comes.”

In a homebuyer study performed by The Farnsworth Group, the participants revealed their reasons for purchasing a new home. The top three factors that influence their purchase include area/location (50.2%), price/affordability (37.4%), and the layout of the home (19%) (as shown in the graph below).

“The first impressions are important when entering a new community, as is feeling welcome in the community. Amenities such as clubhouses, pools, and walking trails featured prominently in the decision to purchase in a community. Location was key, as residents want their new homes to be near shopping, dining, medical services and entertainment.”

Many people wonder whether they should hire a real estate professional to assist them in buying their dream home or if they should first try to do it on their own. In today’s market: you need an experienced professional!

The field of real estate is loaded with land mines; you need a true expert to guide you through the dangerous pitfalls that currently exist. Finding a home that is priced appropriately and is ready for you to move into can be tricky. An agent listens to your wants and needs, and can sift through the homes that do not fit within the parameters of your “dream home.”A great agent will also have relationships with mortgage professionals and other experts that you will need in securing your dream home.

Last week, CNBC ran an article quoting self-made millionaire David Bach explaining that not purchasing a home is "the single biggest mistake millennials are making" because buying real estate is "an escalator to wealth.”Bach went on to explain:

"If millennials don't buy a home, their chances of actually having any wealth in this country are little to none. The average homeowner to this day is 38 times wealthier than a renter."

In his bestselling book, “The Automatic Millionaire,” Bach does the math:

"As a renter, you can easily spend half a million dollars or more on rent over the years ($1,500 a month for 30 years comes to $540,000), and in the end wind up just where you started — owning nothing. Or you can buy a house and spend the same amount paying down a mortgage, and in the end wind up owning your own home free and clear!"

The latest Existing Home Sales Report from the National Association of Realtors (NAR)revealed a direct correlation between a lack of inventory and rising prices.

We are all familiar with the concept of supply and demand. As the demand for an item increases the supply of that same item goes down, driving prices up.

Year-over-year inventory levels have dropped each of the last 18 months, as inventory now stands at a 4.0-month supply, well below the 6.0-month supply needed for a ‘normal’ market.

The median price of homes sold in November (the latest data available) was $234,900, up 6.8% from last year and marking the 57th consecutive month with year-over-year gains.

NAR’s Chief Economist, Lawrence Yun had this to say:

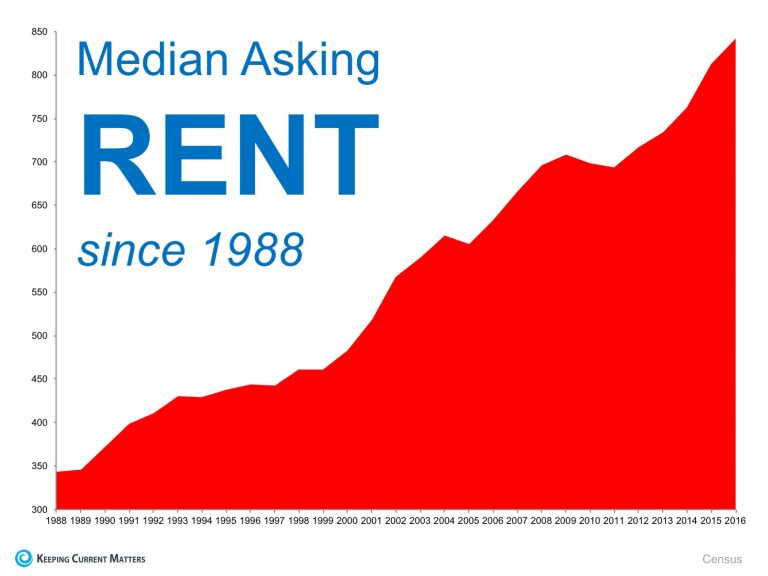

"Existing housing supply at the beginning of the year was inadequate and is now even worse heading into 2017. Rental units are also seeing this shortage. As a result, both home prices and rents continue to far outstrip incomes in much of the country."

When it comes to buying a home, whether you are a rookie homebuyer or have gone through the process many times, having a local real estate expert who is well versed in the neighborhood you are looking to move into, as well as the trends of that area, should be your goal.

One great example of an agent who is in your corner and is always looking out for your best interests is one of the main characters on ABC’s Modern Family, Phil Dunphy.

For those who aren’t familiar, the character Phil is a Realtor with a huge heart who always strives to do his best for his family and his clients.In one recent episode, Phil even shared the oath that he created and holds himself accountable to:

"On my honor, I promise to aid in man's quest for shelter, to recognize I'm not just in the business of houses -- I'm in the business of dreams in the shape of houses. To disclose all illegal additions, shoddy construction, murders, and ghosts. And to put my clients' needs before my own."

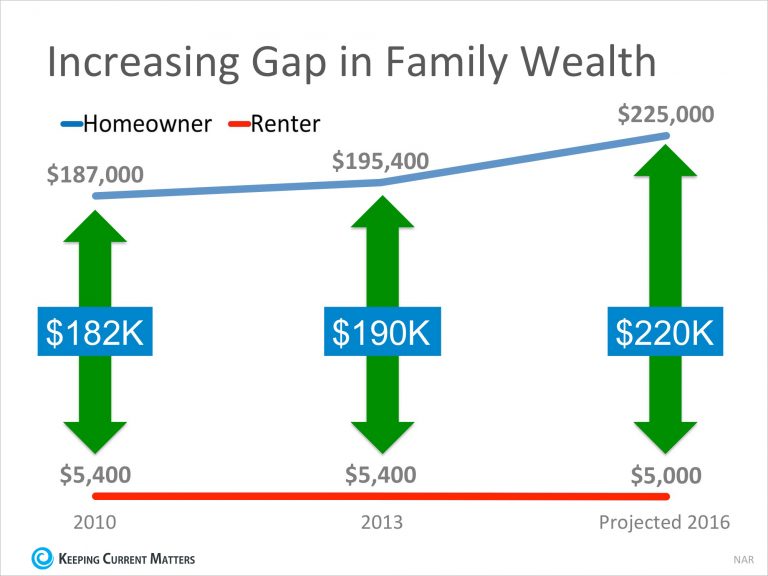

Every three years, the Federal Reserve conducts a Survey of Consumer Finances in which they collect data across all economic and social groups. The latest survey, which includes data from 2010-2013, reports that a homeowner’s net worth is 36 times greater than that of a renter ($194,500 vs. $5,400).

In a Forbes article, the National Association of Realtors’ (NAR) Chief EconomistLawrence Yun predicts that by the end of 2016, the net worth gap will widen even further to 45 times greater.

The graph below demonstrates the results of the last two Federal Reserve studies and Yun’s prediction:

“Though there will always be discussion about whether to buy or rent, or whether the stock market offers a bigger return than real estate, the reality is that homeowners steadily build wealth. The simplest math shouldn’t be overlooked.”

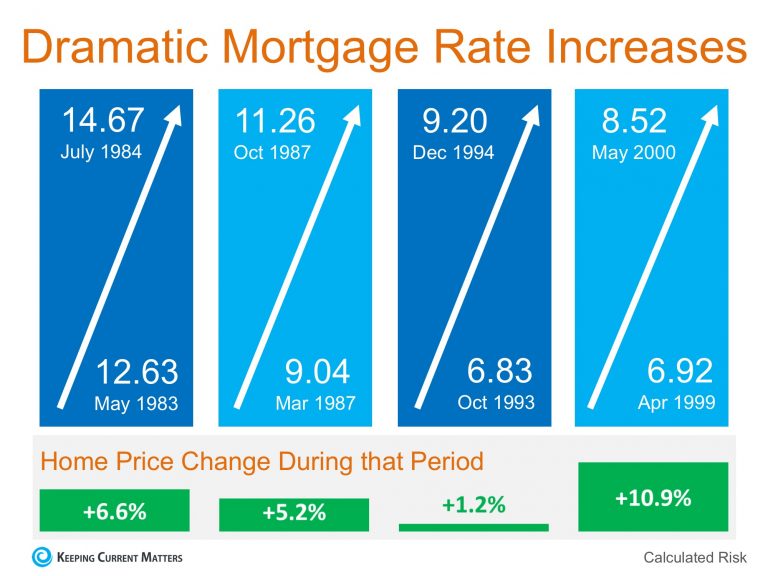

There are some who are calling for a decrease in home prices should mortgage interest rates begin to rise rapidly. Intuitively, this makes sense as the cost of a home is determined by the price of the home, plus the cost of financing that home. If mortgage interest rates increase, fewer people will be able to buy, and logic says prices will fall if demand decreases

However, history shows us that this has not been the case the last four times mortgage interest rates dramatically increased.

Here is a graph showing what actually happened:

“[P]rices weren’t especially sensitive to rising rates, particularly in the presence of other positive economic factors, such as strong job growth, rising wages and improving consumer confiden

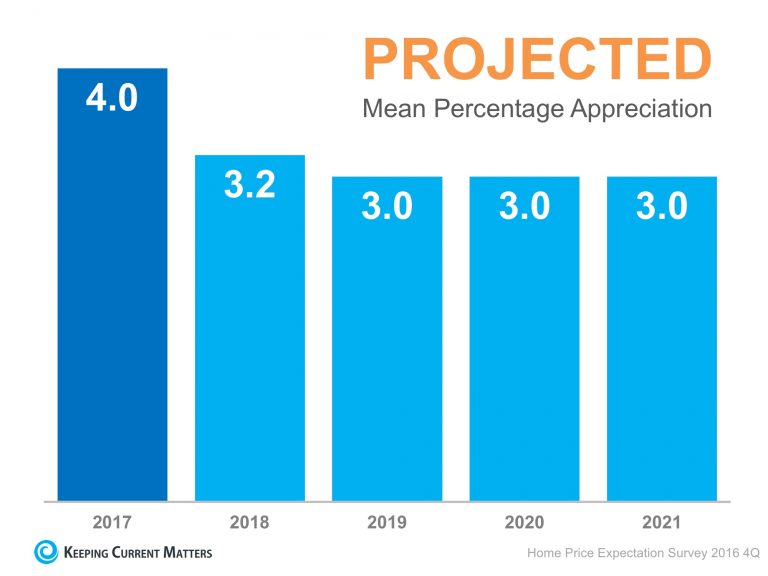

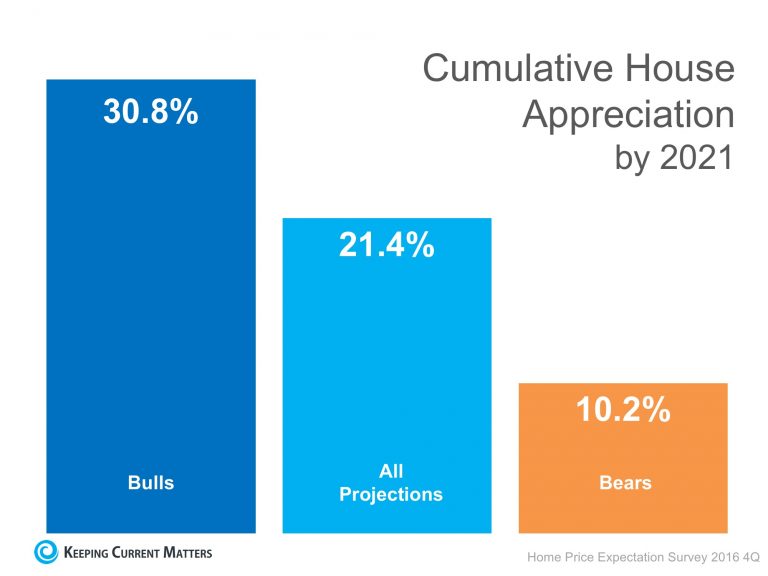

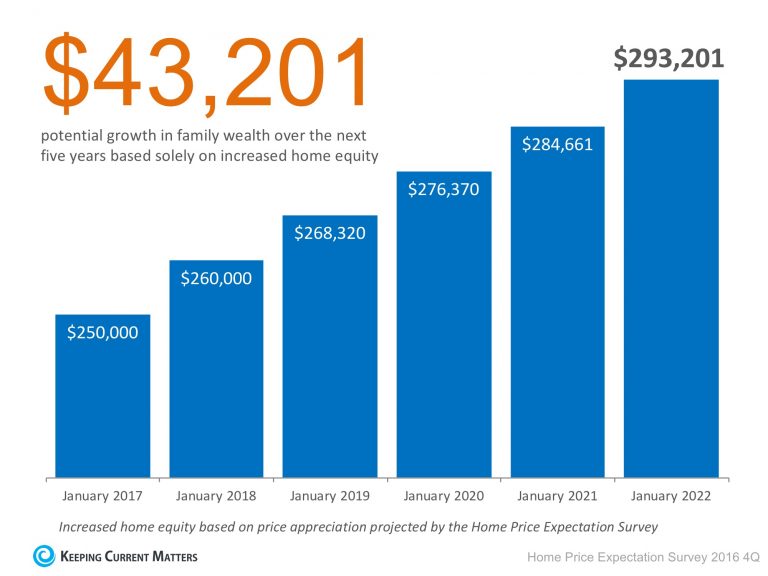

Today, many real estate conversations center on housing prices and where they may be headed. That is why we like the Home Price Expectation Survey

Every quarter, Pulsenomics surveys a nationwide panel of over one hundred economists, real estate experts, and investment & market strategists about where they believe prices are headed over the next five years. They then average the projections of all 100+ experts into a single number.

The results of their latest survey:

Home values will appreciate by 4.0% over the course of 2017, 3.2% in 2018 and 3.0% the next three years (as shown below). That means the average annual appreciation will be 3.24% over the next 5 years.

People often ask if now is a good time to buy a home. No one ever asks when a good time to rent is. However, we want to make certain that everyone understands that today is NOT a good time to rent.The Census Bureau recently released their third quarter median rent numbers. Here is a graph showing rent increases from 1988 until today:

According to a recent report by Trulia, “buying is cheaper than renting in 100 of the largest metro areas by an average of 37.7%.” That may have some thinking about buying a home instead of signing another lease extension, but does that make sense from a financial perspective?

“Owning a home is one of the most common ways households build long-term wealth, as it acts like a forced savings account. Instead of paying your landlord, you can pay yourself in the long run through paying down a mortgage on a house.”

As the temperature in many areas of the country starts to cool down, you might think that the housing market will do the same. This couldn’t be further from the truth! Here are 4 reasons you should consider buying your dream home this winter instead of waiting for spring!

1. Get financing

2. Find your home

3. Make and have offer accepted

4. Inspections, Appraisals, Final underwriting

5. Close and move in

We will add some detailed information here

We will add some detailed information here

We will add some detailed information here

We will add some detailed information here

We will add some detailed information here

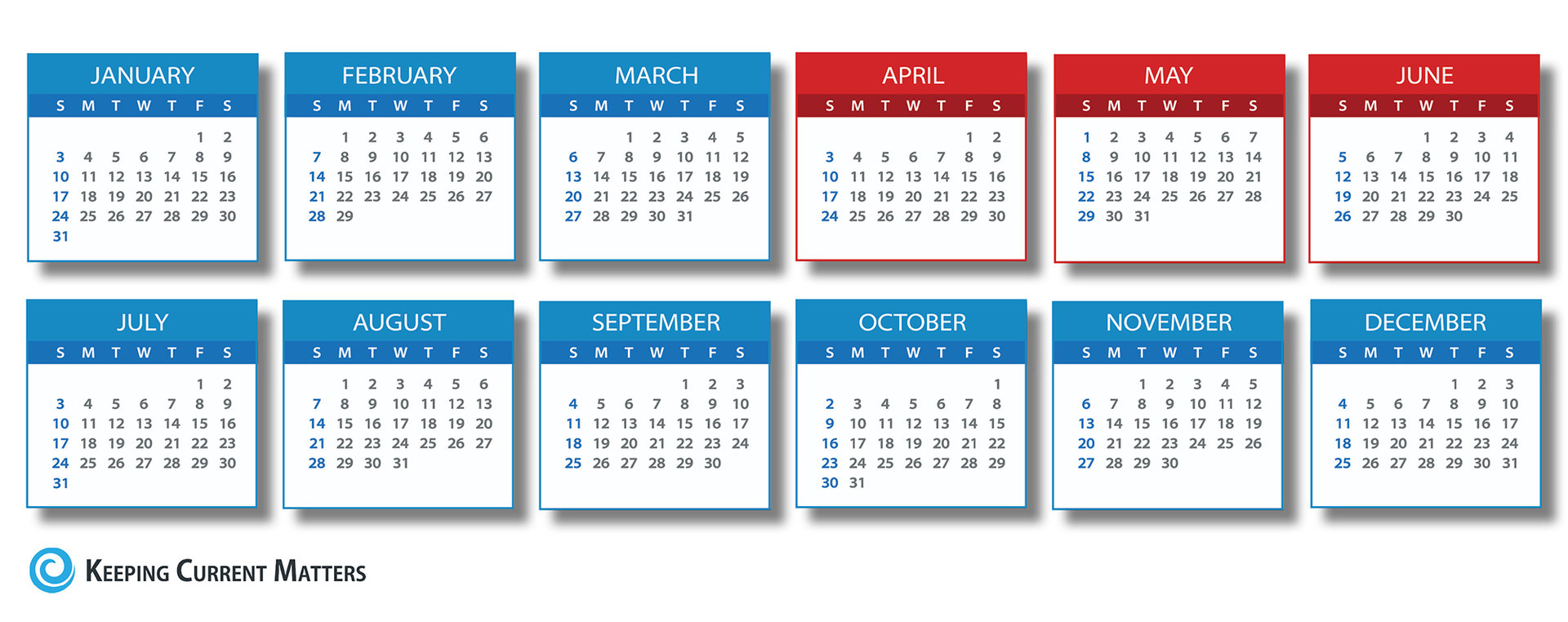

A recent study of more than 7 million home sales over the past four years revealed that the season in which a home is listed may be able to shed some light on the likelihood that the home will sell for more than asking price, as well as how quickly the sale will close.

It’s no surprise that listing a home for sale during the spring saw the largest return, as the spring is traditionally the busiest season for real estate. What is surprising, though, is that listing during the winter came in second!

“Among spring listings, 18.7 percent of homes fetched above asking, with winter listings not far behind at 17.5 percent. While 48.0 percent of homes listed in spring sold within 30 days, 46.2 percent of homes in winter did the same.”

The study goes on to say that:

“Buyers [in the winter] often need to move, so they’re much less likely to make a lowball offer and they’ll often want to close quickly — two things that can make the sale much smoother.”

If you are debating listing your home for sale in 2017, keep in mind that the spring is when most other homeowners will decide to list their homes as well. Listing your home this winter will ensure that you have the best exposure to the serious buyers who are out looking now!

The study used the astronomical seasons to determine which season the listing date fell into (Winter: Dec. 21 – Mar. 20; Spring: Mar. 21 – June 20; Summer: June 21 – Sept 21; Autumn: Sept 21 – Dec. 20).

Recently there has been a lot of talk about home prices and if they are accelerating too quickly. As we mentioned before, in some areas of the country, seller supply (homes for sale) cannot keep up with the number of buyers out looking for a home, which has caused prices to rise.

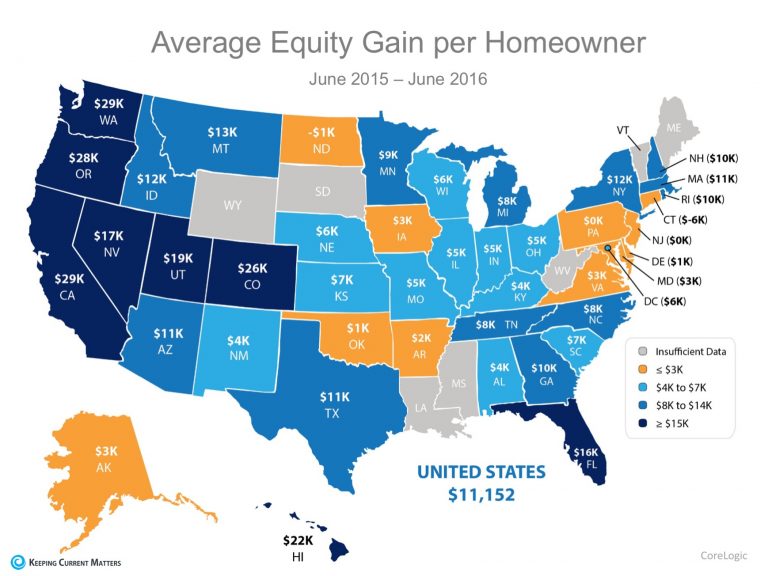

The great news about rising prices, however, is that according to CoreLogic’s US Economic Outlook, the average American household gained over $11,000 in equity over the course of the last year, largely due to home value increases.

The map below was created using the same report from CoreLogic and shows the average equity gain per mortgaged home from June 2015 to June 2016 (the latest data available).

For those who are worried that we are doomed to repeat 2006 all over again, it is important to note that homeowners are investing their new-found equity in their homes and themselves, not in depreciating assets.

The added equity is helping families put their children through college, invest in starting small businesses, allowing them to pay off their mortgage sooner or move up to the home that will better suit their needs now.

CoreLogic predicts that home prices will appreciate by another 5% by this time next year. If you are a homeowner looking to take advantage of your home equity by moving up to your dream home, contact an agent in your area to discuss your options!

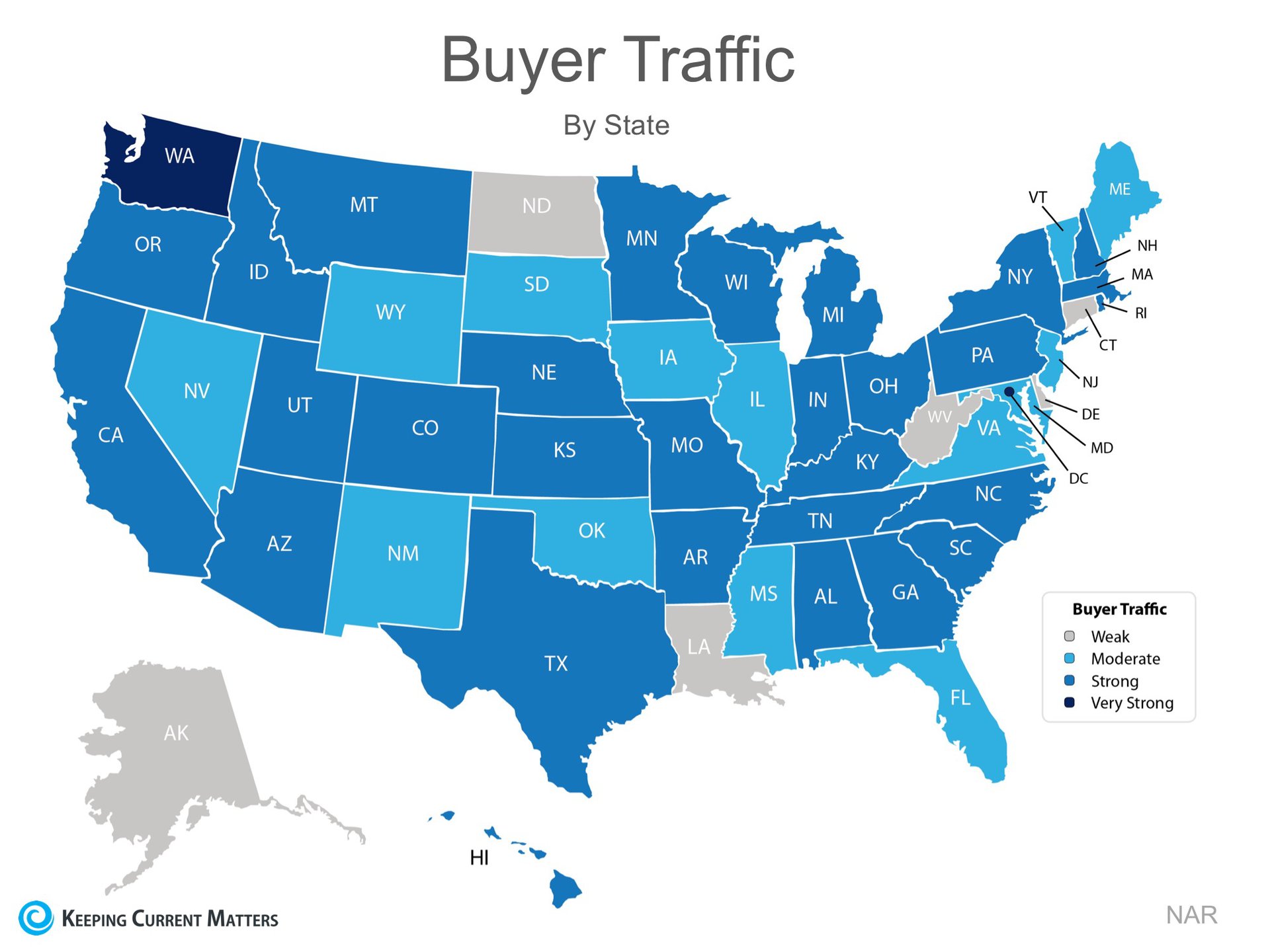

The price of any item is determined by the supply of that item, as well as the market demand. The National Association of REALTORS (NAR) surveys “over 50,000 real estate practitioners about their expectations for home sales, prices and market conditions” for their monthly REALTORS Confidence Index.

Their latest edition sheds some light on the relationship between Seller Traffic (supply) and Buyer Traffic (demand).

The map below was created after asking the question: “How would you rate buyer traffic in your area?”

The darker the blue, the stronger the demand for homes in that area. Only six states had a weak demand level.

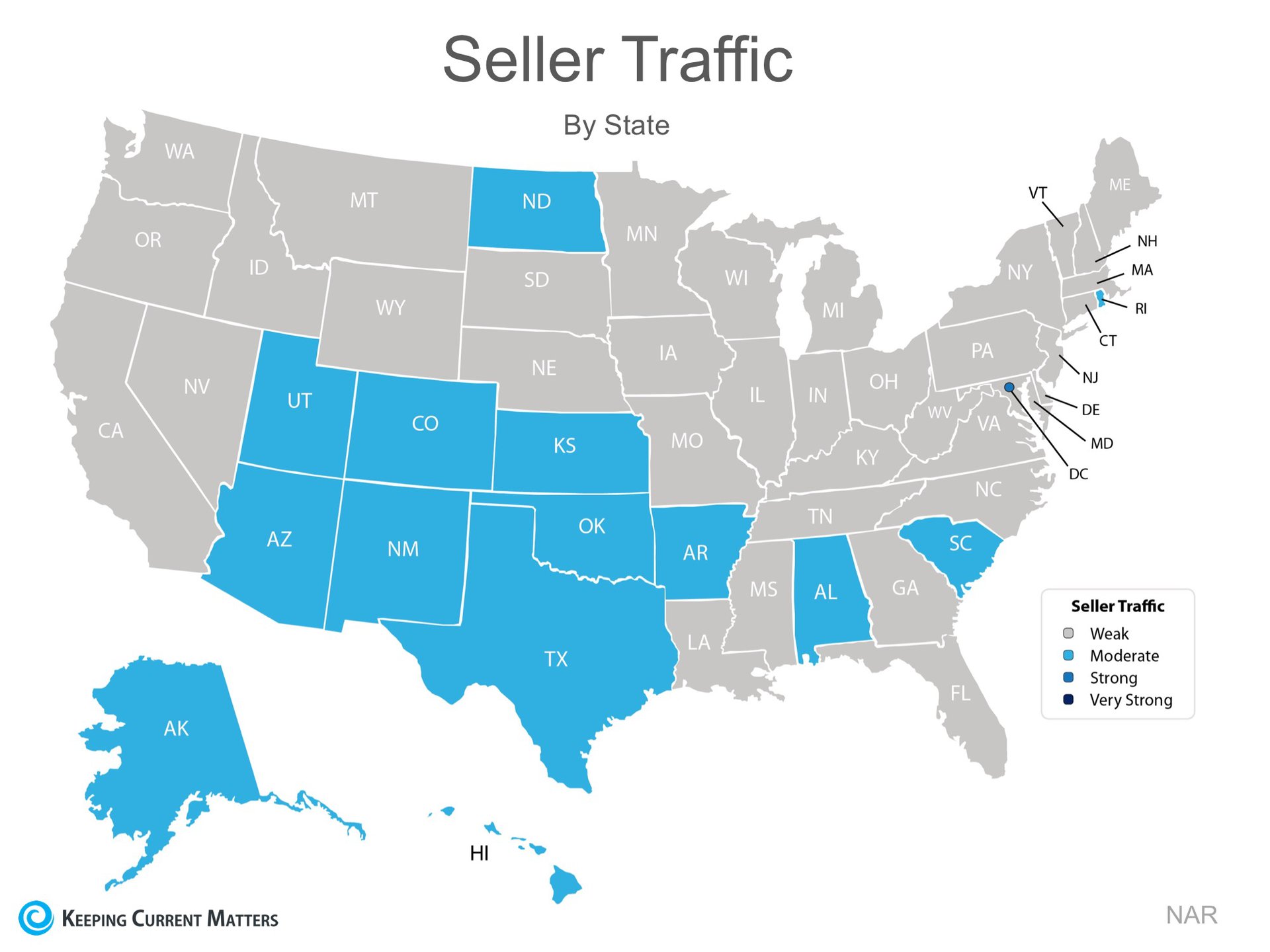

The Index also asked: “How would you rate seller traffic in your area?”

As you can see from the map below, the majority of the country has weak Seller Traffic, meaning there are far fewer homes on the market than what is needed to satisfy the buyers who are out looking for their dream homes.

Looking at the maps above, it is not hard to see why prices are appreciating in many areas of the country. Until the supply of homes for sale starts to meet the buyer demand, prices will continue to increase. If you are debating listing your home for sale, meet with a local real estate professional in your area who can help you capitalize on the demand in the market now!

Is spring closer than we think? Depending on which groundhog you listen to today, you may have less time than you think to get your home on the market before the busy spring season.

Many sellers feel that the spring is the best time to place their homes on the market as buyer demand traditionally increases at that time of year. However, the next six weeks before spring hits also have their own advantages.

Foot traffic refers to the number of people who are out, physically looking at homes right now. The latest foot traffic numbers from the National Association of Realtors (NAR) show that the number of buyers out looking for their dream homes in December reached the highest mark since February 2016.

These buyers are ready, willing and able to buy…and are in the market right now! Take advantage of the strong buyer activity currently in the market.

Housing inventory just dropped to a 3.6-month supply, which is well under the 6-month supply needed for a normal housing market. This means, in many areas, there are not enough homes for sale to satisfy the number of buyers in that market. This is good news for home prices; however, additional inventory is about to come to market.

There is a pent-up desire for many homeowners to move, as they were unable to sell over the last few years because of a negative equity situation. Homeowners are now seeing a return to positive equity as real estate values have increased over the last four years. Many of these homes will be coming to market soon.

Also, new construction of single-family homes is again beginning to increase. A study by Harris Poll revealed that 41% of buyers would prefer to buy a new home, while only 21% prefer an existing home (38% had no preference).

The choices buyers have will increase in the spring. Don’t wait for this other inventory to come to market before you sell.

One of the biggest challenges of the housing market has been the length of time it takes from contract to closing. Banks are requiring more and more paperwork before approving a mortgage. There is less overall business done in the winter. Therefore, the process will be less onerous than it will be in the spring. Getting your house sold and closed before the spring delays begin will lend to a smoother transaction.

If you are moving up to a larger, more expensive home, consider doing it now. Prices are projected to appreciate by 4.7% over the next 12 months according to CoreLogic. If you are moving to a higher priced home, it will wind-up costing you more in raw dollars (both in down payment and mortgage payment) if you wait. You can also lock-in your 30-year housing expense with an interest rate around 4% right now. Rates are projected to rise by half a percentage point by the end of 2017.

Look at the reason you decided to sell in the first place and determine whether it is worth waiting. Is money more important than being with family? Is money more important than your health? Is money more important than having the freedom to go on with your life the way you think you should?

Only you know the answers to the questions above. You have the power to take back control of the situation by putting your home on the market. Perhaps, the time has come for you and your family to move on and start living the life you desire.

The most recent Pending Homes Sales Index from the National Association of Realtorsrevealed a slight bump in contracts with an increase of 1.6% in December. This news comes as existing home sales are also forecasted to be on pace for 5.54 million in 2017, a 1.7% increase over 2016, which was the best year for sales in a decade.

The Pending Home Sales Index is a leading indicator for the housing sector, based on pending sales of existing homes. A sale is listed as pending when the contract has been signed but the transaction has not closed.

According to NAR’s Chief Economist, Lawrence Yun,

“Pending sales bounded last month as enough buyers fended off rising mortgage rates and alarmingly low inventory levels to sign a contract.”

Buyers are searching for existing homes, but supply is not keeping up with their demand!

Yun went on to explain,

“The main storyline in the early months of 2017 will be if supply can meaningfully increase to keep price growth at a moderate enough level for households to absorb higher borrowing cost. Sales will struggle to build on last year’s strong pace if inventory conditions don’t improve.” (emphasis added)

Buyers are out in force right now! If you are considering selling your home this year, the early months of 2017 will be your best option. Contact a local professional today to capitalize on current market conditions.

It is common knowledge that a large number of homes sell during the spring-buying season. For that reason, many homeowners hold off on putting their homes on the market until then. The question is whether or not that will be a good strategy this year.

The other listings that do come out in the spring will represent increased competition to any seller. Do a greater number of homes actually come to the market in the spring, as compared to the rest of the year? The National Association of Realtors (NAR) recently revealed the months in which most people listed their homes for sale in 2016. Here is a graphic showing the results:

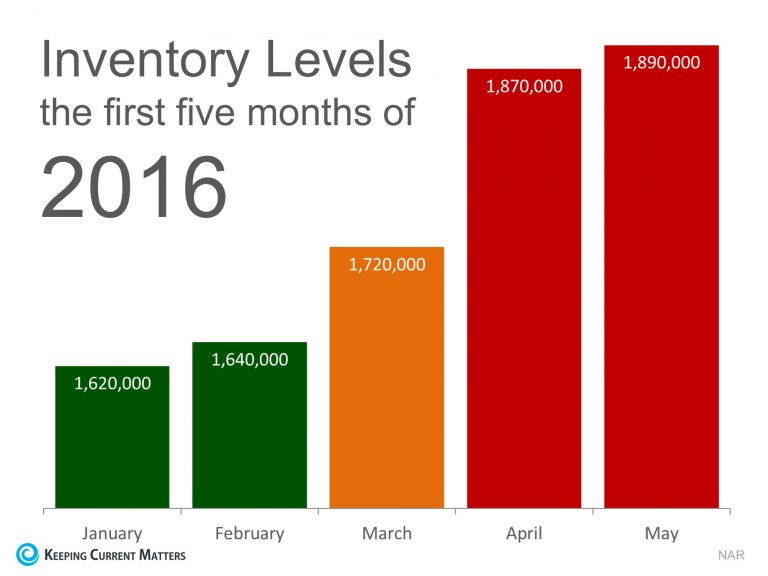

The three months in the second quarter of the year (represented in red) are consistently the most popular months for sellers to list their homes on the market. Last year, the number of homes available for sale in January was 1,820,000.

With the national job situation improving, and mortgage interest rates projected to rise later in the year, buyers are not waiting until the spring; they are out looking for a home right now. If you are looking to sell this year, waiting until the spring to list your home means you will have the greatest competition for a buyer.

It may make sense to beat the rush of housing inventory that will enter the market in the spring and list your home today.

The residential housing market has been hot. Home sales have bounced back solidly and are now at their second highest pace since February 2007. Demand has remained strong throughout the winter as many real estate professionals are reporting bidding wars with many homes selling above listing price. What about your house?

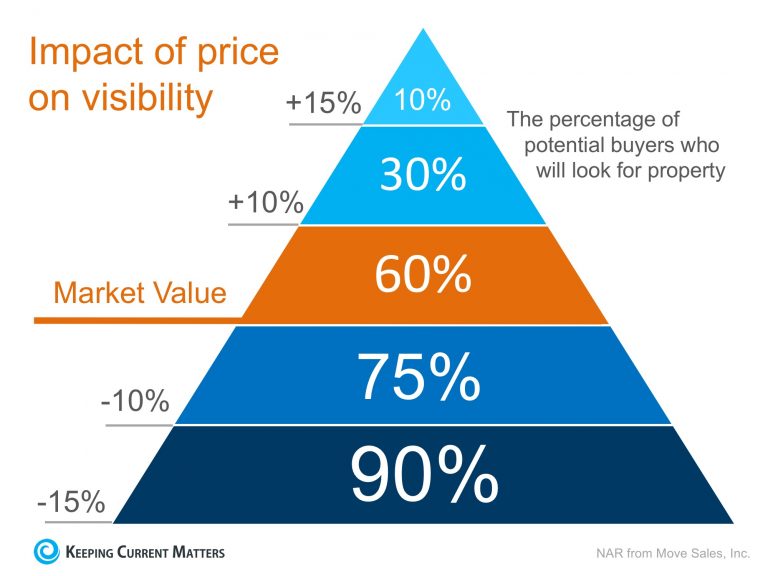

If your home is on the market and you are not receiving any offers, look at your price. Pricing your home just 10% above market value dramatically cuts the number of prospective buyers that will even see your house. See chart below.

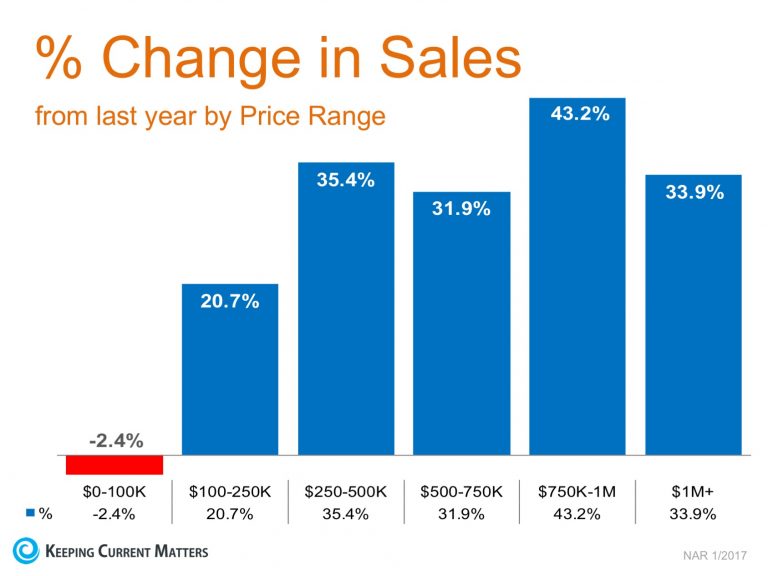

The National Association of Realtors’ most recent Existing Home Sales Report revealed that, compared to last year, home sales are up dramatically in five of the six price ranges they measure.

Homes priced between $100-250K showed a 20.7% increase year-over-year. This is an impressive increase, showing that November was an excellent month for home sales in this price range.

But surprisingly, the 20.7% increase in sales in this range was not the highest percent change achieved, as sales of homes over $250,000 increased by double-digit percentages with sales in the $750,000- $1 million range showing the largest increase, up 43.2%!

As prices in many markets continue to accelerate, it is no surprise to see the percentage of homes in the higher price ranges increasing.

As we are about to bring in the New Year, families across the country will be deciding if this is the year that they will sell their current house and move into their dream home. Many will decide that it is smarter to wait until the spring “buyer’s market” to list their house. In the past, that might have made sense. However, this winter is not like recent years.

The recent jump in mortgage rates has forced buyers off the fence and into the market, resulting in incredibly strong demand RIGHT NOW!! At the same time, inventory levels of homes for sale have dropped dramatically as compared to this time last year.

Here is a chart showing the decrease in inventory levels by category:

In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their home on their own, known in the industry as a For Sale by Owner (FSBO). There are several reasons why this might not be a good idea for the vast majority of sellers.

Here are the top five reasons:

The paperwork involved in selling and buying a home has increased dramatically as industry disclosures and regulations have become mandatory. This is one of the reasons that the percentage of people FSBOing has dropped from 19% to 8% over the last 20+ years.

Many homeowners believe that they will save the real estate commission by selling on their own. Realize that the main reason buyers look at FSBOs is because they also believe they can save the real estate agent’s commission. The seller and buyer can’t both save the commission.

Studies have shown that the typical house sold by the homeowner sells for $185,000, while the typical house sold by an agent sells for $245,000. This doesn’t mean that an agent can get $60,000 more for your home, as studies have shown that people are more likely to FSBO in markets with lower price points. However, it does show that selling on your own might not make sense.

Over the next five years, home prices are expected to appreciate 3.24% per year on average and to grow by 21.4% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey.

So, what does this mean for homeowners and their equity position?

As an example, let’s assume a young couple purchases and closes on a $250,000 home in January. If we look at only the projected increase in the price of that home, how much equity will they earn over the next 5 years?

Not only is homeownership something to be proud of, but it also offers you and your family the ability to build equity you can borrow against in the future. If you are ready and willing to buy, find out if you are able to, today!

The price of any item (including residential real estate) is determined by ‘supply and demand’. If many people are looking to buy an item and the supply of that item is limited, the price of that item increases.According to the National Association of Realtors (NAR), the supply of homes for sale dramatically increases every spring. As an example, here is what happened to housing inventory at the beginning of 2016:

Buyers in the market during the winter months are truly motivated purchasers. They want to buy now. With limited inventory currently available in most markets, sellers are in a great position to negotiate.

If you are one of the many homeowners who is debating taking your home off the market for the next few weeks, don’t! You will miss the great opportunity you have right now!The latest Existing Home Sales Report from The National Association of Realtors (NAR), revealed that the inventory of homes for sale has dropped to a 4.3-month supply.Historically, a 6-month supply is necessary for a ‘normal’ market, explained below:

Home prices are appreciating in this seller’s market. Making your home available over the next few weeks will give you the most exposure to buyers who will be competing against each other to buy it.

A recent study of more than 7 million home sales over the past four years revealed that the season in which a home is listed may be able to shed some light on the likelihood that the home will sell for more than asking price, as well as how quickly the sale will close.

It’s no surprise that listing a home for sale during the spring saw the largest return, as the spring is traditionally the busiest month for real estate. What is surprising, though, is that listing during the winter came in second!

“Among spring listings, 18.7 percent of homes fetched above asking, with winter listings not far behind at 17.5 percent. While 48.0 percent of homes listed in spring sold within 30 days, 46.2 percent of homes in winter did the same.”

“Buyers [in the winter] often need to move, so they’re much less likely to make a lowball offer and they’ll often want to close quickly — two things that can make the sale much smoother.”

If you are debating listing your home for sale within the next 6 months, keep in mind that the spring is when most other homeowners will decide to list their homes as well. Listing your home this winter will ensure that you have the best exposure to the serious buyers who are out looking now!

Buying a new home is so personal. Yet, to sell yours, you'll want to remove so many of your homey, personal touches. This is part of staging your home: buyers should be able to picture themselves living in your house - not picture you living in your house. Successful staging will boost your home's appeal and your chances of selling. There are two rooms that often need the most staging: bedrooms and bathrooms. You might decide your house looks good enough as-is. But even in a strong market, a little staging could boost the offers your recieve.

Staging lets you see your house with fresh perspective and helps you correct any eyesores you may have become used to over the years. It helps you to view some of your beloved items as clutter and gives you the initiative to clear away inneeded items. Staging will also help you in the packing process, which inevitably involves streamlining and downsizing.

A bedroom should be a place of serenity. Stage your bedroom to convey a tone of comfort and relaxation. You want it to appear spacious. Here are some tips for presenting your bedroom:

• Paint it in soft, neutral tones

• Remove all furniture other than a bed, a dresser and a few knickknacks

• Remove at least half of your wardrobe from your closet to make the closet seem larger

• Clear away clutter, shoes, reading material and family photos

• Invest in new linens and throw pillows

• Steam clean the carpets, clean the windows and dust the shades

Purchasers don't spend a Lot of time in bathrooms, so your bathrooms have to make a great first impression. Bathrooms should be impeccably clean and somewhat modern. Here are some bathroom staging tips:

• Replace old bathroom fixtures, such as towel rods and faucets, with sleek new ones

• Hang luxurious-Looking towels to match the bathroom's color scheme

• Layer towels on the rack, smaller towels over larger towels

• Before an open house, put a bouquet of fresh flowers in the bathroom

• Ruthlessly clean mold and dirt from tiles and shower doors

• Add spa-Like accessories, such as candles, scented soaps in baskets and glass containers holding cotton balls

Cleanliness trumps all. Buyers have to imagine themselves living in your home, and they will have a hard time picturing themselves Living in a dirty house. In fact. the top of your to-do list when you List home to sell should be a deep, through clean Like your house probably hasn't seen since you moved in.

• Remove mold and mildew

• Scour away lime stains left by hard water

• Clean windows inside and out

• Steam carpets

• Wash all Linens and curtains If you smoke or have a pet. be especially vigilant about eradicating those odors-because a clean, well-staged home should bring you a quick and profitable sale.

1. Pricing it right the first time

2. Light it up

3. Find the right agent

4. Take the home out of your house

5. Always be ready to show

6. The first impression is the only impression

Find out what your home is worth and have it appraised. You'll be stampeded by buyers with multiple bids- even worst markets- and they'll bid up the price over what it's worth. It takes real courage and most sellers just don't want to risk it, but it's the single best strategy to sell a home in today's market.

Maximize the light in your home. After location, good light is the one thing that every buyer cites that they want in a home. Take down the drapes, clean the windows, change the lampshades, increase the wattage of your lightbulbs and cut the bushes outside to let in the sunshine. Do what you have to do to make your house bright and cheery - it will make it more sellable.

A secret sale killer is hiring the wrong agent. Make sure you have an agent who is totally informed. They must constantly monitor the multiple listing service (MLS), know what properties are going on the market and know the comps in your neighborhood.

One of the most important things to do when selling your house is to de-personalize it. The more personal stuff in your house, the less potential buyers can imagine themselves living there. Get rid of a third of your stuff - put it in storage.

Your house needs to be "show-ready" at all times - you never know when your buyer is going to walk through the door. You have to be available whenever they want to come see the place and it has to be in tip-top shape.

No matter how good the interior of your home looks, buyers have already judged your home before they walk through the door. You never have a second chance to make a first impression. It is important to make people feel warm, welcome and safe as they approach the house. Spruce up your home's exterior with inexpensive shrubs and brightly colored flowers. You can typically get 100% return on the money you put into your home's curb appeal.

1. Listing appointment

2. Stage your home

3. List home and begin marketing campaign

4. Negotiate and accept offer

5. Close and hand over the keys

Meet with Dave to discuss you goals.

Buying a new home is so personal. Yet, to sell yours, you'll want to remove so many of your homey, personal touches. This is part of staging your home: buyers should be able to picture themselves living in your house - not picture you living in your house. Successful staging will boost your home's appeal and your chances of selling. There are two rooms that often need the most staging: bedrooms and bathrooms. You might decide your house looks good enough as-is. But even in a strong market, a little staging could boost the offers your recieve. See "Staging Your Home" above.

We will sell you home by..

This means...

We did it!

1. Replace/Clean Up Your Front Door

2. Add Outdoor Entertaining Space

3. Create More Room

4. Simple Remodel To Kitchen

5. Update Windows

6. Pay Attention To Lighting

7. Replace Your Window Treatments

8. Update Bathrooms

9. Replace Siding/Paint Exterior

10. Clean Up Closets

A fresh front door makes a clean impression on potential buyers. Not to mention a new door yields 86% return on your investment. Perhaps your front door does not need to be replaced or you don't want to spend that much money, you can always paint and replace hardware for close to the same impression.

Buyers are always looking for an outdoor entertaining area. You can regain 77% of your investment on adding a wooden deck. If you currently have outdoor entertaining area, consider rehabbing it with a fountain, fire pit, or fresh landscaping.

Pending your budget, adding rooms, finishing off an attic space, or adding more open living area dramatically increases value. Typically this yields a 73% return on your investment.

Buyers are very critical of kitchens and bathrooms. You can recoup 75% of a small kitchen remodel and 60-68% of a major kitchen remodel. If you're selling in the near future, be aware of not to overspend on your kitchen remodel. It may just take a couple small things to lively up your kitchen such as painting cabinets or replacing countertops. Sometimes its the small things that generate the offers!

Buyers notice new from older windows. A commonly asked question from a buyer is "are these windows energy efficient"? Replacing vinyl or wood-frame windows, you could expect a 72% return on investment (ROI). New windows are a great marketing item.

In today's market, buyer tend to take a liking to bright and light rooms. Take a look around your home and see if you need to upgrade your lighting fixtures or add more. You can always hire a handyman to add recessed lights to your kitchen and living areas. Be sure to replace outdated overhead lighting fixtures to match contemporary tastes.

Make sure to maximize as much natural lighting into your home and that your window treatments don't hide any oversized

Although a full bathroom rehab can cost a ridiculous amount of upwards to $50,000, there are also very cost effective tricks that can make a bathroom appear brand new! Replace fixtures and mirrors, fresh paint and jazz it up with some crown molding (depending on your home's style) and you're old out dated bathroom will be looking great. Redo caulk around the tub and shower to clean everything up. Rather than replacing the tub if its in bad shape, you can always have it resurfaced.

If your properties exterior is in need of help, you can plan on recouping 72% of your ROI by replacing the siding or repainting exterior. Not to mention this would help tremendously with your homes curb appeal.

Buyers are always looking at a homes storage. If your closets are piled high and unorganized, buyers will not see the potential of storage in them.

When choosing your repairs to make, be sure to not over invest in them before trying to sell. Make sure you consult with your Realtor to find out what repairs make the most "cents" for your situation.

We’ve all heard about how “bad” the real estate market is. But what’s bad for sellers can be good for buyers, and these days, savvy buyers are out in spades trying to take advantage of the buyer’s market. Here are 13 thing you can do to help sell your house.

92% of homebuyers start their house hunt online, and they will never even get in the car to come see your home if the online listings aren’t compelling. In real estate, compelling means pictures! A study by Trulia.com shows that listings with more than 6 pictures are twice as likely to be viewed by buyers as listings that had fewer than 6 pictures.

Get a $125 FlipCam and walk through your home AND your neighborhood, telling prospective buyers about the best bits – what your family loved about the house, your favorite bakery or coffee shop that you frequented on Saturday mornings, etc. Buyers like to know that a home was well-loved, and it helps them visualize living a great life there, too.

If you belong to neighborhood online message boards or email lists, send a link to your home’s online listing to your neighbors. Also, invite your neighbors to your open house – turn it into a block party. That creates opportunities for your neighbors to sell the neighborhood to prospective buyers and for your neighbors to invite house hunters they know who have always wanted to live in the area.

Facebook is the great connector of people these days. If you have 200 friends and they each have 200 friends, imagine the power of that network in getting the word out about your house!

We’ve all heard about closing cost credits, but those are almost so common now that buyers expect them – they don’t really distinguish your house from any of the other homes on the market anymore. What can distinguish your home is leaving behind some of your personal property, ideally items that are above and beyond what the average homebuyer in your home’s price range would be able to afford. That may be stainless steel kitchen appliances or a plasma screen TV, or it might be a golf cart if your home is on a golf course.

In many markets, much of the competition is low-priced foreclosures and short sales. As an individual homeowner, the way you can compete is on condition. Consider having a termite inspection in advance of listing your home, and get as many of the repairs done as you can – it’s a major selling point to be able to advertise a very low or non-existent pest repair bill. Also, make sure that the little nicks and scratches, doorknobs that don’t work, and wonky handles are all repaired before you start showing your home.

Stage the exterior with fresh paint, immaculate landscaping and even outdoor furniture to set up a Sunday brunch on the deck vignette. Buyers often fantasize about enjoying their backyards by entertaining and spending time outside.

Homes that don’t get shown don’t get sold. And many foreclosures and short sale listings are vacant, so they can be shown anytime. Don’t make it difficult for agents to get their clients into your home – if they have to make appointments way in advance, or can only show it during a very restrictive time frame, they will likely just cross your place off the list and go show the places that are easy to get into.

Today’s buyers are very educated about the comparable sales in the area, which heavily influence the fair market value of your home. And they also know that they’re in the driver’s seat. To make your home competitive, have your broker or agent get you the sales prices of the three most similar homes that have sold in your area in the last month or so, then try to go 10-15% below that when you set your home’s list price. The homes that look like a great deal are the ones that get the most visits from buyers and, on occasion even receive multiple offers. (Bidding wars do still exist!)

Work with your broker or agent to get educated about the price, type of sale and condition of the other homes your home is up against. Attend some open houses in your area and do a real estate reality check: know that buyers that see your home will see those homes, too – make sure the real-time comparison will come out in your home’s favor by ensuring the condition of your home is up to par.

Do this – pretend you’re moving out. Take all the things that make your home “your” personal sanctuary (e.g., family photos, religious décor and kitschy memorabilia), pack them up and put them in storage. Buyers want to visualize your house being their house – and it’s difficult for them to do that with all your personal items marking the territory as yours.

Keep the faux-moving in motion. Pack up all your tchotchkes, anything that is sitting on top of a countertop, table or other flat surfaces. Anything that you haven’t used in at least a year? That goes, too. Give away what you can, throw away as much as possible of what remains, and then pack the rest to get it ready to move.

If you find an experienced real estate agent to list your home, who has a successful track record of selling homes in your area, listen to their recommendations! Find an agent you trust and follow their advice as often as you can.

30 Min Prep Time

1 Hr 35 Min Total Time

12 Servings

Here's a fun way to end your day at the beach! Kids can help arrange teddy bear-shaped graham snacks on top of frosted cupcakes.

Found on bettycrocker.com

Ingredients

1 box Betty Crocker™ SuperMoist™ cake mix (any flavor) Water, vegetable oil and eggs called for on cake mix box

2 drops blue food color

1 cup Betty Crocker™ Whipped vanilla frosting

1 roll (from 4.5-oz box) Betty Crocker™ Fruit by the Foot™ chewy fruit snack (any flavor)

1/2 cup teddy bear-shaped graham snacks, crushed, or brown sugar

1 tablespoon Betty Crocker™ blue sugar, if desired

12 teddy bear-shaped graham snacks

6 paper drink umbrellas or small plastic umbrellas, if desired

6 ring-shaped gummy candies

6 multi-colored fish-shaped crackers

Directions

1. Heat oven to 350°F (325°F for dark or nonstick pans). Place paper baking cup in each of 24 regular-size muffin cups. Make and bake cake mix as directed on box for 24 cupcakes. Cool in pans 10 minutes; remove from pans to cooling rack. Cool completely, about 30 minutes. Tightly wrap 12 cupcakes; freeze for a later use.

2. Stir blue food color into frosting until blended. Frost remaining 12 cupcakes with frosting.

3. Cut six 1 1/2-inch pieces from fruit snack roll; peel off paper backing. Use fruit snack and remaining ingredients to decorate cupcakes as shown in photo or as desired.

Vegetarian

1 Hr Total Time

12 Servings

Make a fun, summery peach cobbler that everybody will love that's ready to share in about 1 hour.

Ingredients

For the filling:

8 fresh peaches, peeled, pitted and sliced

Directions

1. Preheat oven to 425 degrees. In a large bowl, combine sliced peaches, 1/4 cup white sugar, 1/4 cup brown sugar, 1/2 teaspoon cinnamon, nutmeg, lemon juice, vanilla or almond extract, and cornstarch.

2. Toss to coat peaches evenly and pour into a 2-quart baking dish or 5-6 individual baking dishes. Bake in preheated oven for 10 minutes.

3. Meanwhile, in a medium bowl, combine flour, 1/4 cup white sugar, 1/4 cup brown sugar, baking powder, and salt. Blend in butter with a pastry cutter or your fingertips until mixture resembles coarse meal. Stir in boiling water until just combined. In a small bowl, stir together the 3 tablespoons of white sugar with 1 teaspoon of cinnamon.

4. Remove peaches from oven, and drop spoonfuls of topping over them. Sprinkle the cinnamon and sugar mixture evenly over the topping. Bake for 25-35 minutes, or until topping is golden brown. Serve warm with vanilla ice cream.

Whip up a fruity breakfast, snack or dessert in seconds.

Read More on The Food Network

1. Banana Blend 2 bananas, 1/2 cup each vanilla yogurt and milk, 2 teaspoons honey, a pinch of cinnamon and 1 cup ice.

2. Strawberry-Banana Blend 1 banana, 1 cup strawberries, 1/2 cup each vanilla yogurt and milk, 2 teaspoons honey, a pinch of cinnamon and 1 cup ice.

3. Strawberry Shortcake Blend 2 cups strawberries, 1 cup crumbled pound cake, 1 1/2 cups each milk and ice, and sugar to taste. Top with whipped cream and more strawberries.

4. Triple-Berry Blend 1 1/2 cups mixed blackberries, strawberries and raspberries with 1 cup each milk and ice, and sugar to taste.

5. Raspberry-Orange Blend 1 cup each orange juice and raspberries, 1/2 cup plain yogurt, 1 cup ice, and sugar to taste.

6. Peach-Mango-Banana Blend 1 cup each chopped fresh or frozen peaches and mango, 1 cup each plain yogurt and ice, 1/2 banana, and sugar to taste.

7. Honeydew-Almond Blend 2 cups chopped honeydew melon, 1 cup each almond milk and ice, and honey to taste.

8. Cantaloupe Blend 2 cups chopped cantaloupe, the juice of 1/2 lime, 3 tablespoons sugar, 1/2 cup water and 1 cup ice.

9. Carrot-Apple Blend 1 cup each carrot juice and apple juice with 1 1/2 cups ice.

10. Spa Cucumber Peel, seed and chop 2 medium cucumbers. Blend with the juice of 1 lime, 1/2 cup water, 1 cup ice and 3 to 4 tablespoons sugar or honey.

11. Kiwi-Strawberry Blend 1 cup strawberries, 2 peeled kiwis, 2 tablespoons sugar and 2 cups ice.

12. Cherry-Vanilla Blend 1 1/2 cups frozen pitted cherries, 1 1/4 cups milk, 3 tablespoons sugar, 1/2 teaspoon vanilla extract, 1/4 teaspoon almond extract, a pinch of salt and 1 cup ice.

13. Tangerine-Honey Peel and seed 4 tangerines, then blend with the juice of 2 limes, 1/4 cup honey and 1 cup ice.

14. Apricot-Almond Blend 1 1/2 cups apricot nectar, 1/2 cup vanilla yogurt, 2 tablespoons almond butter and 1 cup ice.

15. Grape Blend 2 cups seedless red grapes with 1 cup concord grape juice and 1 1/2 cups ice.

16. Blueberry-Pear Blend 1 1/2 cups frozen blueberries, 1 chopped pear, 1 1/2 cups each maple or plain yogurt and ice, and sugar to taste.

17. Banana-Date-Lime Blend 2 bananas, 3/4 cup chopped pitted dates, the juice of 1 lime and 1 1/2 cups each soy milk and ice.

18. Peach-Ginger Blend 2 cups frozen sliced peaches, 1 1/2 cups buttermilk, 3 tablespoons brown sugar and 1 tablespoon grated fresh ginger.

19. Grapefruit Peel and seed 2 grapefruits, then blend with 3 to 4 tablespoons sugar and 1 cup ice. Sprinkle with cinnamon.

20. Pomegranate-Cherry Blend 1 cup frozen pitted cherries, 3/4 cup pomegranate juice, 1/2 cup plain yogurt, 1 tablespoon honey, 1 teaspoon lemon juice, a pinch each of cinnamon and salt, and 2 cups ice.

21. Chai Blend 1 1/2 cups chai tea concentrate with 1 cup each milk and ice. Sprinkle with chai spice or ground cinnamon.

22. Blueberry-Banana Blend 1 banana, 1 cup blueberries, 1/2 cup unsweetened coconut milk, 1 tablespoon each honey and lime juice, 1/4 teaspoon almond extract and 1 cup ice.

23. Creamy Pineapple Blend 2 cups chopped pineapple, 1/2 cup cottage cheese, 1/4 cup milk, 2 teaspoons honey, 1/4 teaspoon vanilla, a pinch each of nutmeg and salt, and 2 cups ice.

24. Watermelon Freeze 3 cups cubed seeded watermelon until hard. Blend with 1 cup cubed fresh seeded watermelon, the juice of 1 lime, 1/4 cup sugar and 1 cup water.

25. Pineapple-Coconut Freeze about 2 cups coconut water in 1 or 2 ice-cube trays. Blend 2 cups each chopped pineapple and coconut ice cubes, 1 1/2 tablespoons lime juice, 1 tablespoon honey and 1/2 cup coconut water.

31. Mexican Coffee Blend 1/2 cup chilled espresso or strong coffee, 1/2 cup milk or almond milk, 3 1/2 tablespoons brown sugar, 1/4 teaspoon ground cinnamon, 1/8 teaspoon almond extract and 1 1/2 cups ice.

32. Vietnamese Coffee Blend 1/2 cup chilled espresso or strong coffee, 1/4 cup sweetened condensed milk and 1 1/2 cups ice. Top with chocolate shavings and/or chocolate syrup.

33. Banana PB&J Blend 1 frozen banana with 1 cup soy milk, 1/4 cup each creamy peanut butter and wheat germ, and 2 tablespoons seedless strawberry or raspberry jelly.

34. Peanut Butter–Apple Blend 1 chopped peeled apple, 3 tablespoons creamy peanut butter, 2 tablespoons flaxseeds, 1 1/2 cups each soy milk and ice, and honey to taste.

35. Pomegranate-Berry Blend 1 cup blueberries, 3/4 cup each beet juice and pomegranate juice, 1 cup ice, and honey to taste.

36. Cucumber-Kale Blend 1 1/4 cups vegetable juice, 1/2 peeled cucumber, 3 kale leaves and the juice of 1/2 lemon.

37. Pineapple-Mango Blend 1 cup each chopped pineapple and mango, 1 cup coconut water, a dash of ground allspice and 1 cup ice. Sprinkle with toasted coconut.

38. Peanut Butter–Banana Blend 1 banana, 1 cup vanilla yogurt, 1/2 cup creamy peanut butter, 1/3 cup milk, 2 tablespoons malted milk powder, 1/2 teaspoon cocoa powder, a pinch of salt and 2 cups ice.

39. Green Tea–Almond Brew 1 1/2 cups extra-strong green tea; cool completely. Blend with 1/3 cup almonds, 1/4 cup honey and 1 cup ice.

40. Chocolate-Banana Blend 1 banana, 1 cup chocolate ice cream, 1/2 cup milk, a pinch of salt and 1/2 cup ice.

41. Chocolate-Raspberry Blend 1 cup each chocolate ice cream and raspberries, 2 tablespoons sugar and 3/4 cup each milk and ice.

42. Strawberry-Maple Blend 2 cups strawberries, 1 1/2 cups milk, 1/4 cup each maple syrup and wheat germ, a dash of ground cinnamon and 1 1/2 cups ice.

43. Chocolate Chip Cookie Blend 1 cup each vanilla ice cream, milk and crumbled chocolate chip cookies with 1/4 cup mini chocolate chips. Top with a cookie.

44. Oatmeal Cookie Blend 1 cup each vanilla ice cream, milk and crumbled oatmeal cookies with a pinch of ground cinnamon. Top with a cookie.

45. Birthday Cake Blend 1 1/2 cups vanilla ice cream, 1 crumbled vanilla cupcake (unfrosted), 1 cup milk and 1/4 teaspoon almond extract. Top with sprinkles.

46. Black and White Blend 3/4 cup each vanilla ice cream and chocolate ice cream with 1 cup milk and 3 crumbled chocolate sandwich cookies. Top with a cookie.

47. Lemon–Poppy Seed Blend 2 teaspoons poppy seeds, the zest and juice of 1/2 lemon, 1 cup plain yogurt, 1/3 cup sugar and 1/2 cup each milk and ice.

48. Apple-Spinach Blend 2 cups spinach, 1 chopped peeled apple, 1/2 cup silken tofu, 1/4 cup each soy milk and orange juice, 1 tablespoon each wheat germ, honey and lemon juice, and 1 cup ice.

49. Veggie Blend 1 1/4 cups tomato juice, 1/4 cup carrot juice, 1/2 peeled cucumber, 1/2 celery stalk, 1/4 cup each parsley and spinach, and 1/2 cup ice.

50. Mint-Jalapeno Blend 1/3 cup fresh mint, 1 seeded jalapeno pepper, 2 1/2 tablespoons honey, a pinch of salt and 2 cups each plain yogurt and ice. Top with toasted cumin seeds and cilantro.

Check out this European Inspired Recipe

Makes 6 Servings

As seen on recipes.howstuffworks.com

Ingredients

2 large cucumbers, peeled, seeded and chopped, divided

1-1/2 cups salsa, divided

1 cup chicken broth

1/2 cup vegetable juice cocktail

1 teaspoon hot pepper sauce

6 tablespoons crumbled feta cheese

2 medium tomatoes, chopped

Fresh basil leaves (optional)

Preparation

1. Place half of cucumber, half of salsa, broth and juice in food processor or blender container; process until smooth. Combine remaining cucumber, remaining salsa and hot pepper sauce in medium bowl; stir in puréed mixture. Cover and refrigerate 15 minutes or up to 24 hours.

2. To serve, ladle gazpacho into 6 individual bowls, dividing evenly. Top each serving with 1 tablespoon feta cheese and 1 teaspoon tomato. Garnish with basil leaves, if desired.

25 min Total Time

6 Servings

Easy to Make

Try it with tuna, crab, avocado or any combination of the three. What other ingredients might you add?

The 2 recipes combined make 6 pieces.

Ingredients for the tuna wrap

1 teaspoon mayonnaise

1/2 teaspoon wasabi paste

1 or 2 drops sesame oil

1 soft flour tortilla wrap

1/2 carrot, peeled and cut into matchsticks to give 1/2 cup

Quarter cucumber, halved lengthways, seeded and cut into matchsticks to give 1/2 cup

3 ounces tuna, sliced into 1/16 by 3/4-inch rectangles

Directions for the tuna wrap